The Church Treasurer: Reporting, Credit Cards, and Other Tips

Image

Read the series.

My wife was in pre-op for delicate tear duct surgery this past Monday. Two surgeons were involved: an otorhinolaryngologist and an ophthalmologist. The younger of the two, the ENT doctor marked Kathee’s left eye – it’s this one. In walked the older of the two1 who announced, “I’m not a surgeon, but I did sleep in a Holiday Inn Express last night.”2 Well, he really is a surgeon and I’m not an accountant and I haven’t slept in Holiday Inn Express in years! But I am resolved to follow GAAP3 and EFCA standards on financial reporting:

ECFA Standard 3 - Financial Oversight:

Every organization shall prepare complete and accurate financial statements. …

The financial statements (and the disclosure of the financial statements) are key components of transparency, both within the ministry and to donors and the public. This flows directly from biblical principles: “This is the verdict: Light has come into the world, but men loved darkness instead of light because their deeds were evil. Everyone who does evil hates the light, and will not come into the light for fear that his deeds will be exposed” (John 3:19–20 NIV).

Transparency serves to deter improper diversion of funds and other misdeeds. It also provides a defense to critics and a witness to both believers and nonbelievers. When Jesus was arrested, He said to the crowd, “Am I leading a rebellion, that you have come out with swords and clubs to capture me? Every day I sat in the temple courts teaching, and you did not arrest me” (Matthew 26:55 NIV). The openness of His public actions revealed a significant contrast to His middle-of-the-night arrest.

The Apostle Paul, too, did his deeds openly. He cites this fact as one basis for his authority over the Thessalonians. “You are witnesses, and so is God, of how holy, righteous, and blameless we were among you who believed” (1 Thessalonians 2:10 NIV). Being transparent with one another assures credibility and authority. 4

The following satisfy ECFA requirements. For ECFA purposes, a complete set of financial statements of a nonprofit organization shall include:

- a statement of financial position as of the end of the reporting period (also referred to as a balance sheet),

- a statement of activities for the reporting period (also referred to as a statement of revenues and expenses),

- expenses reported by their functional classification in the statement of activities, a statement of functional expenses, or the notes to the financial statements,

- a statement of cash flows for the reporting period, and

- accompanying notes to the financial statements.

I suggest that church leadership have as a minimum standard, items 1 through 3. Aplos combines 2 and 3. How I handle each:

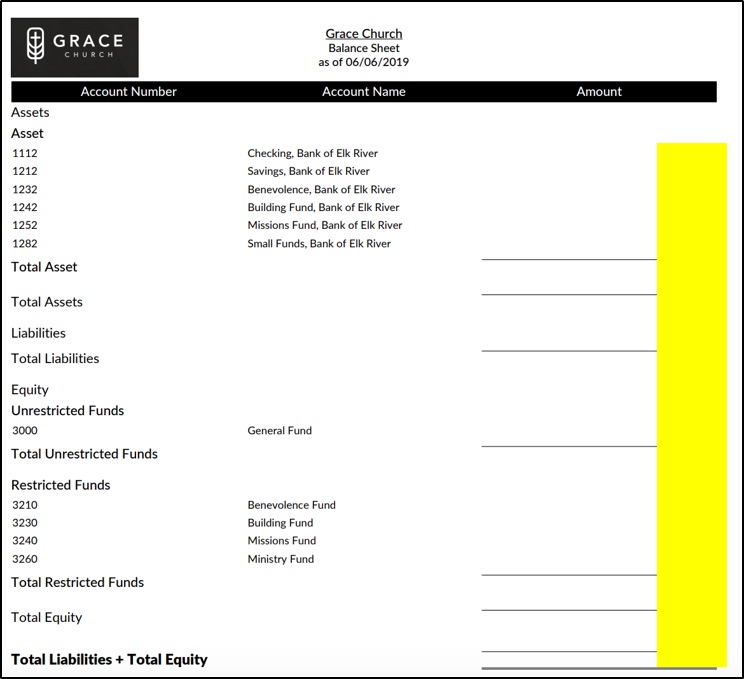

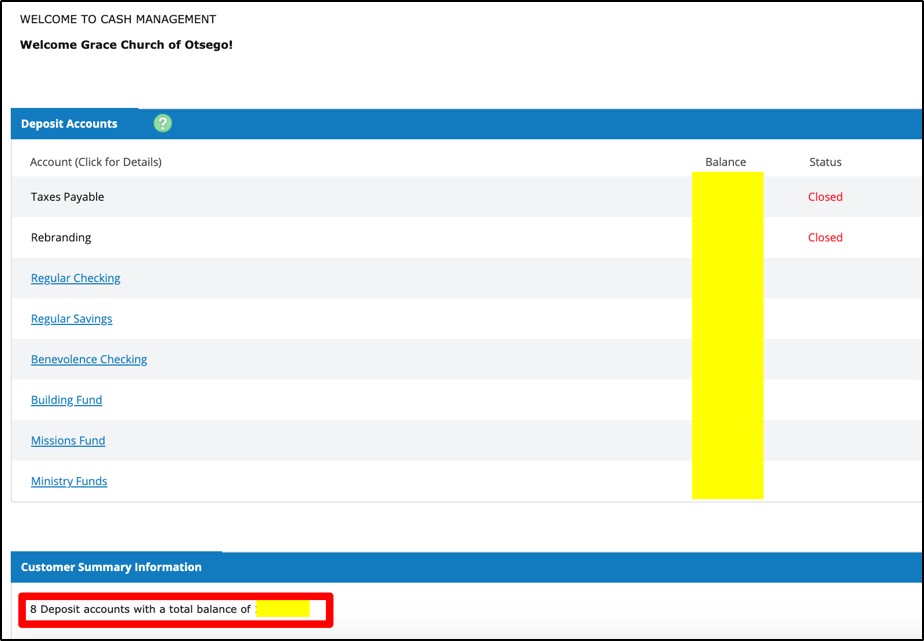

The Balance Sheet

I log onto our bank’s website daily (Monday through Saturday) and track inflows and outflows. I update Aplos daily and run the Balance Sheet daily. The daily activity takes less than a half an hour and most times less than 15 minutes. I follow this daily routine so as to make the month end process move quickly. I validate that the bank balances match the Balance Sheet. The Balance Sheet is a snapshot at a point in time. I provide the board (our pastor and deacons) with the Balance Sheet once per month with a reporting date as the last day of the month.

An important Tip: The Balance Sheet must match the bank balances!

An important Tip: The Balance Sheet must match the bank balances!

The Chart of Accounts (COA)

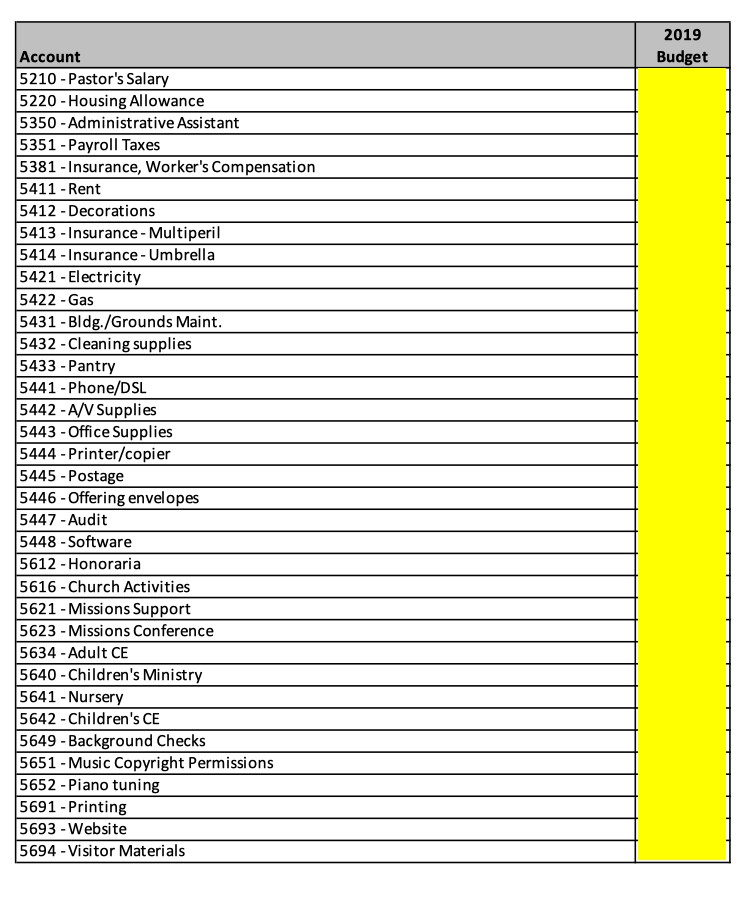

I maintain the COAs in Aplos and provide this list to the board members annually.5

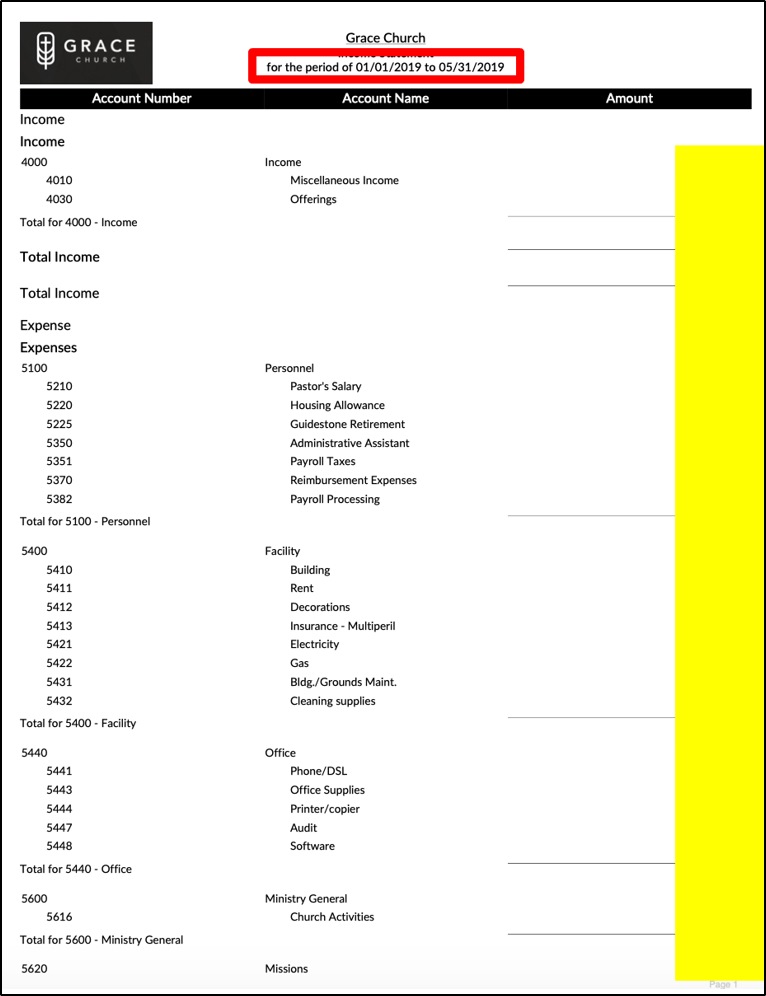

The Income and Expense Statement

While the Balance Sheet is a snapshot in time, the Income and Expense Statement is a look back at a point in time (e.g., the end of the month) to the beginning of an accounting period (e.g., the first of the year).

My wife is a retired bank IT executive. She had to “sweat the details” at month-end because she was required to be within 1% of budget across multiple categories. I personally am not that concerned with matching the budget; I categorize accordingly and report the results to the board.

The Income and Expense Statement is the foundation for the next year’s budget.

I provide two reports: One with budget vs. actual and the other with just the actual numbers.

Cash Flows

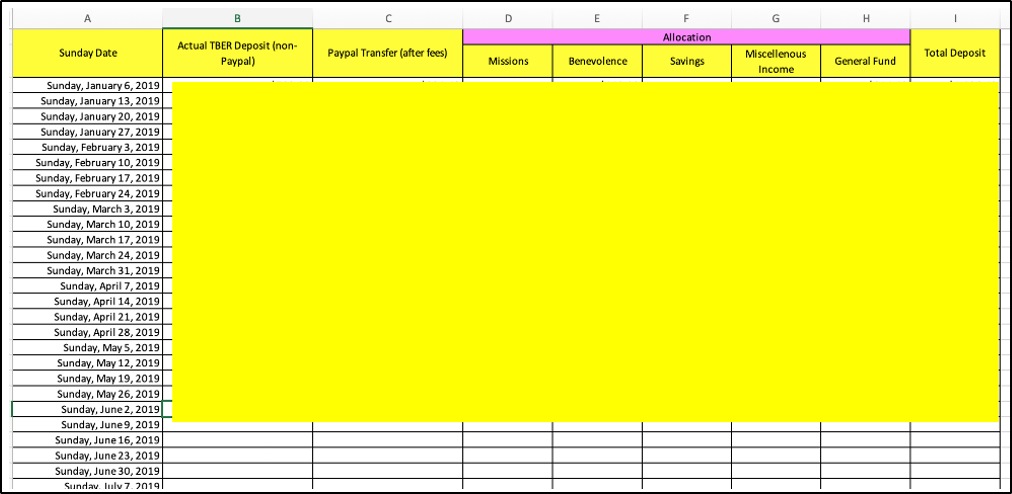

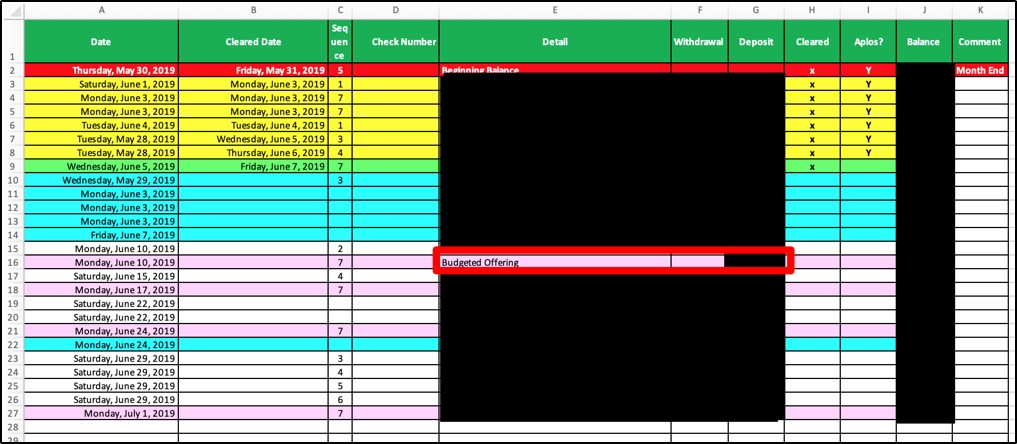

I do not provide a cash flow statement to the board, but I do maintain two cash flow spreadsheets for myself. (I actually maintain a cash flow spreadsheet for my personal finances!) I track actual deposits with fund allocations:

I also maintain a forecast of upcoming debits and credits. (Note: below, boxed is the forecasted weekly offerings).

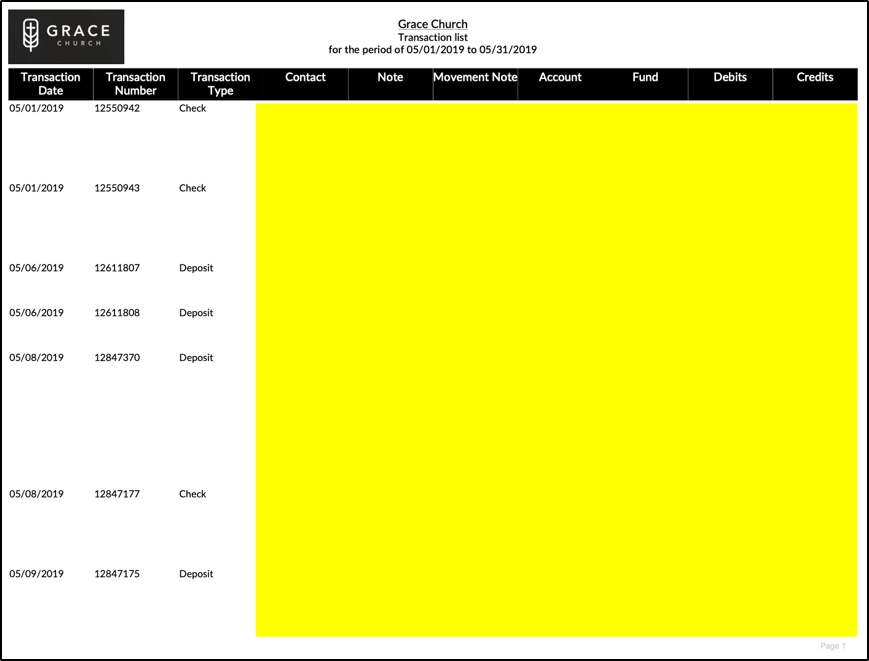

The Transaction Report

“The Income and Expense report and the Balance Sheet are like sausages. You might like the final taste but you don’t want to see how it was made.”6 The Transaction Report is the ledger of all of the month’s transaction details. I provide this to the board in PDF only. It’s the kind of detail (multiple pages) that only an auditor or someone who has insomnia and wants to “get into the weeds”7 would relish!

The Church Credit Card

The Visa statement and processing requires special attention for 3 reasons:

- We have multiple users of the credit card (I’m not one of them).

- Entries require split accounting for a line item.

- Sometimes the purchases are at a wholesale store (e.g., Costco), and I don’t know how to categorize the entry.

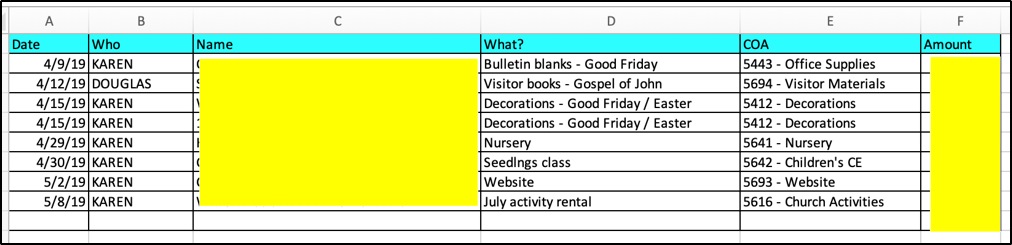

At card statement close, I download the transactions and populate a spreadsheet. I add columns for “what it is” and the “COA” entry (D and E below). If I have a question about the “what,” I email the card user. I provide both the entire Visa statement and my Visa worksheet to the board.

Why I provide notes

I keep a log of sorts in Word with questions, comments, and explanations. Once I made a mistake and I documented that. I provide commentary such as “the offerings were strong last month.” I merge all of my printed reporting into a single PDF so that my comments are the 1st pages followed by the printed Balance Sheet and Income and Expense Statement.

Tips on daily activities

I try to not fall behind, and I eschew procrastination. “Procrastination” could have been “my middle name.” It’s a great evil that has plagued me for all of my years. My process:

- We are early arrivers at church, and Kathee collects all invoices and statements from my Treasurer’s mail slot.

- I process the bills immediately upon returning home from church. I typically can accomplish this while Kathee is making Sunday dinner.

- I update the Cash Flow spreadsheet daily (Monday through Saturday).

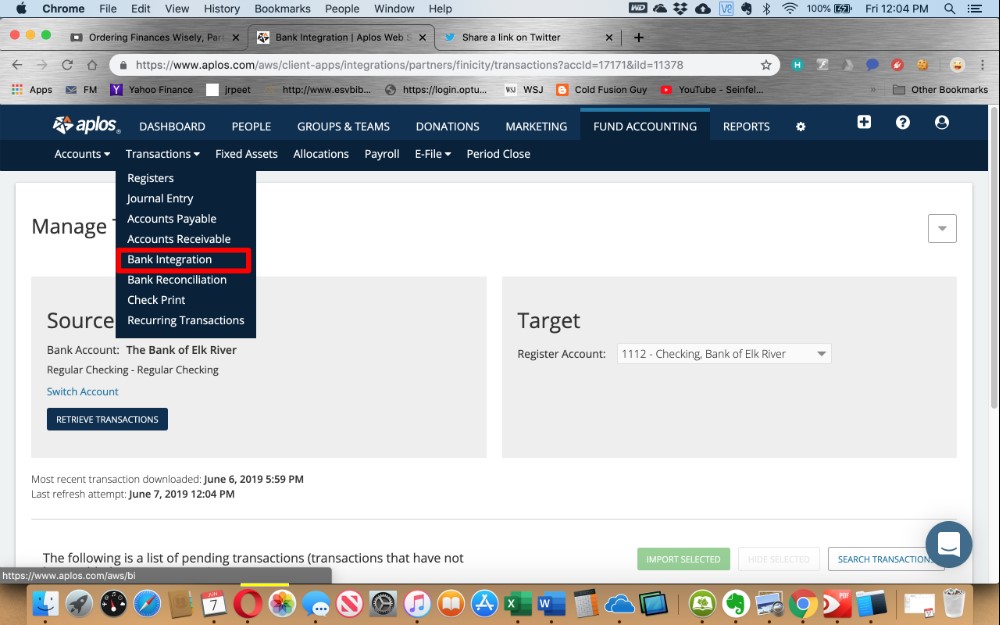

- I log into Aplos and using the Bank Integration function, I code transactions from the queue. (Bank integration is a massive productivity aid!)

- With Aplos and the bank website open, I visually verify that all matches: the Balance Sheet bank section matches the bank.

How I handle Month End

The first month end was very chaotic and was spread over two days. Frustration and procrastination kicked in, and I was ready to quit! I played computer chess and Solitaire interspersed with real work. I had to call Aplos support several times for help. (They have terrific support, by the way!). After the first month end, I created a checklist.

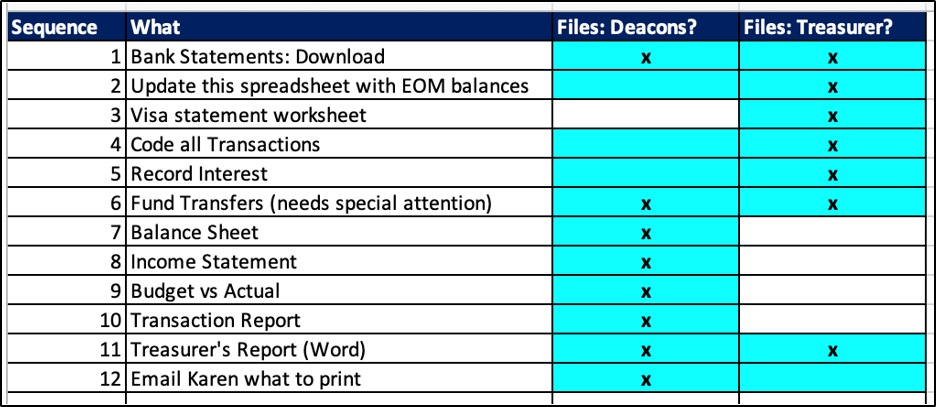

Here’s my 12-step process:8

When I have completed a step, I mark the cell blue.

I am 5 months into my role. The first month-end was spread over multiple days. This past month-end was accomplished in less than two hours. I am learning.

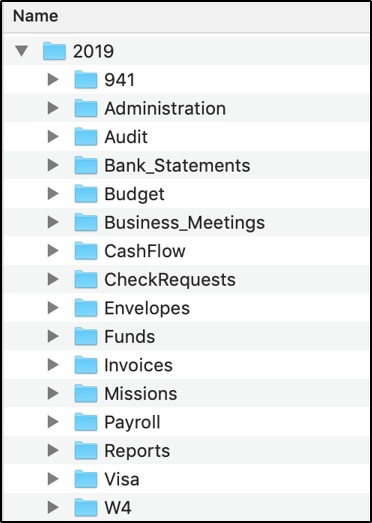

My document filing System

Paper: My wife, Kathee, files every paper statement and invoice by month. My predecessor was more meticulous about printing everything, if it doesn’t cross my desk in paper it does not become paper. Everything emailed to the Treasurer collects into a dedicated email address that is searchable.

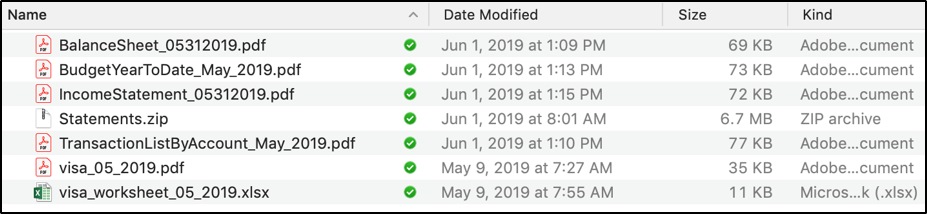

Digital:

What I provide the Board

I download all of the bank statements at month-end and compress them into one Zip archive. I upload all to the church Dropbox. Our board meeting is on the 2nd Monday. The board has these files at least a week before the meeting.

Conclusion

Obviously, the fact that Jim does his job his way does not obligate others to do the same. But these key principles should be followed by all:

- At the very least, the board should be provided a monthly Balance Sheet and Income & Expense Statement.

- Reporting should be timely and accurate.

- The treasurer should maintain a workable filing system.

I’ve found the Treasurer’s role to be a joyous ministry and I trust that others would as well.

Notes

1 Dr. Rakes—he’s a bit of a comic! http://www.parknicollet.com/bios/rakes-m-steven

2 The Holiday Inn Express advertisement: https://youtu.be/eHCTaUFXpP8

3 Worth reading: https://www.accounting.com/resources/gaap/

4 Our church is not a member of the ECFA, but there are many helpful resources on their website: https://www.ecfa.org/Content/Comment3

5 We follow the standard non-profit COA standards. This image is a sampling of our 5000 level expenses. See: https://www.aplos.com/academy/nonprofit/nonprofit-accounting/lessons/wha…

6 A variation of “A novel is like a sausage. You might like the final taste, but you don’t want to see how it was made.” Read more at: https://www.brainyquote.com/topics/sausage

7 http://www.word-detective.com/2011/05/getting-into-the-weeds/

8 NOT this Twelve Step process! https://en.wikipedia.org/wiki/Twelve-step_program

Jim Peet Bio 2016

Jim is a retired pastor and a retired IT professional. He volunteers at Central Seminary.

- 240 views

Much appreciate the series. I think a new treasurer looking to upgrade his/her church’s processes could benefit a lot from it. … or a church that has outgrown a simpler approach.

At the church I pastored, we just didn’t have enough transactions to warrant an approach this complex. Account margins were healthy, and processes pretty routine, so there was no need to look at finances and accounts up close more than once a quarter.

There’s also a major “comfort with technology” factor here. Many treasurers (especially in rural churches, I would imagine) are not ready to give up the paper ledgers, let alone go beyond Excel to Aplos and connect to the bank, etc.

So there’s no one-size-fits-all solution.

Views expressed are always my own and not my employer's, my church's, my family's, my neighbors', or my pets'. The house plants have authorized me to speak for them, however, and they always agree with me.

Discussion