Ordering Finances Wisely, Part 5: The Personal Income and Expense Statement

Image

Read the series so far.

In various phases of life I have spent money without giving much thought or planning to it. The first was when I was in seminary and I had to have the latest book. A professor would mention a book and I would have to have it. Another was when I bought my first CD player. The first CD I bought was an Herb Alpert’s Tijuana Brass album. I soon thought I had to have a library of CDs. The third time was when I bought our first DVD player. First, it was “Lawrence of Arabia,” then many more followed. Another phase—and this probably sounds like “true confessions”—is when I had to have the latest modem (2400 baud) or software (Word Perfect) or hard drive.

A single CD, or book, or DVD, or device is not much of a problem, but unchecked anything becomes a spending issue. My wife, who handled our finances during these phases, put up with a lot! Many counselors can testify that finances are a major cause of marital strife. A secular study from 2009 attempted to quantify the effect finances had upon marriages:

Of all these common things couples fight about, money disputes were the best harbingers of divorce. For wives, disagreements over finances and sex were good predictors of divorce, but finance disputes were much stronger predictors. For husbands, financial disagreements were the only type of common disagreement that predicted whether they would get a divorce. (New York Times)

I observe that it is important to know where and how much one spends. And it is important to know one’s income. This brings us to the personal income and expense statement.

Round One—off the top of your head!

There are forms available on the Internet for this and indeed one may easily use an Excel spreadsheet to create this statement, but I suggest first that you create one off the top of your head—you won’t be that accurate but you can check for accuracy later. If you are single this will be a lot easier but if you are married this will be more fun. Gather your spouse and ask some simple questions. And write down the the answers:

Income

- What is your take home pay? How frequently are you paid? (Don’t try to record taxes and other deductions; keep it simple: just the take home pay!)

Expenses

- How much is the rent (or mortgage)?

- What are the average utility costs (water, electric, gas, and garbage)?

- How much spent on clothing? Restaurants? Child care? Gas? Car maintenance?

- Move on to the other areas: CDs (or MP3s)? DVDs (or streaming)? Books and magazines?

Savings

- How much are we saving?

- Is it automatic?

Charitable donations

- Is there a plan?

- Or what is left over?

- Or do you give emotionally—if you ‘feel like it’?

An obvious truth: you cannot spend more than your income. You may for one month, but you cannot spend more than your income month after month without consequences.

The income (or income and expense) statement records your income and expenses for a particular period in the past. It is different from a budget that projects or plans income and expenses for a period in in the future. You cannot accurately budget for the future until you have successfully and accurately tracked your income and expenses in the past.

The income and expense worksheet is the standard method to track cash inflows and outflows. Multiple examples are available on the Internet and any of of them is probably as good as another (an example).

Round Two—thoroughly document last month

This will take some time. Gather the documents: credit card statements, cash receipts, checkbook statement. Account for every penny! There may be an “aha moment” here where there is a sudden realization that you spend a lot more on a certain item that you think. Document everything! Did your income exceed your expenses?

Round Three—thoroughly document last year

This will take more time. The process is the same.

Isn’t there an easier way?

- There are popular software programs that enable one to track expenses (and income). Income is really the easy part because over the course of a year one will probably have 26 or 52 paychecks. It’s the expenses that are difficult.

- Cash is the leaky bucket. Suppose you take $40 out of the ATM every week—where does that money go?

- Another quick way is to use an account aggregator website such as Mint or Yodlee. These work by one adding various bank and credit accounts to the service. The aggregator service will pull account data and attempt to automatically categorize the expenses. It’s not perfect but with both of the services above, users can adjust the automatic categorization to the appropriate categorization.

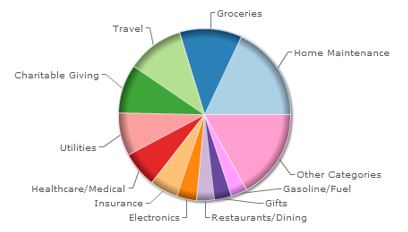

An Example

Our practice

I used Quicken for more than 20 years. Four years ago I began to use Yodlee. I like Yodlee because:

- There is no software to purchase;

- I can view and use it on any computer (Mac/Linux/Windows) and location (home or work);

- I export data for a period (say a year) and import into Microsoft Access for more thorough analysis.

Jim Peet Bio 2016

Jim is a retired pastor and a retired IT professional. He volunteers at Central Seminary.

- 50 views

[G. N. Barkman]Why? If one demonstrates that he can manage them advantageously, why should another say that they should be avoided? Perhaps I should say that failing to use credit cards wisely, and forfeiting the potential hundreds of dollars of annual rewards is wrong? But then, I am not inclined to require something that is clearly a matter of liberty. Why do some Christians feel the need to try to regulate every area of another’s life?

Good question; the explanation I’ve heard comes from Ron Blue of Crown Financial. Apparently back in the 1970s, studies were performed that indicated that credit card users spent about 35% more when they used credit cards than when they spent cash. In the intervening years, of course, we’ve gotten ATMs on every corner, so one would guess that the “extra” paid by credit card users would be matched by cash spenders no longer constrained by “banker’s hours” in getting cash to spend.

What your extra spending is, of course, would depend on your personality, psychology, proximity to banks and ATMs, acceptance of credit cards, and the like.

One other reason one might choose to avoid all kinds of debt, beyond the Biblical admonition to be wary of it, is that debt is the currency that the government and the Federal Reserve use to manipulate the economy and us. But that said, neither psychology nor politics are sufficient to (as you note) justify me telling you what you can and cannot do. It is a lot like the alcohol debate in that regard.

Aspiring to be a stick in the mud.

For me it’s about risk management. Of course it’s possible to use a card and pay it back in full when the bill comes. This has never made sense to me though. Some relatively small kickbacks can be had, I guess, but I can’t completely get away from this logic: borrowing is borrowing. So why would I borrow from my future if I have the funds to make the purchase now? The way I’m wired, it just doesn’t make sense.

That said, I do use credit and more than I’d like. But there’s never been a card purchase I wouldn’t have preferred to pay up front.

I don’t like owing at all. But psychologically, secured debt feels much more sensible than non-secured.

(Aside on ccards vs. alcohol… I work with crime data every day. Trust me, there is no comparison to “card debt as a contributing factor to poor health and violent crime” vs. “alcohol as a contributing factor to poor health and violent crime.” The former is so small, it’s not usually even tracked. The latter has whole bureaucracies devoted to it… along w/drug abuse. I’ll grant though, that both can result in normally sensible people resorting to very desperate and foolish choices)

Views expressed are always my own and not my employer's, my church's, my family's, my neighbors', or my pets'. The house plants have authorized me to speak for them, however, and they always agree with me.

Every Friday night

w bank billpay

every Saturday morning, we are debt free

Sounds like a lot of work, to me. :-)

But I suppose, when it comes to the mechanics of a cash flow management routine, what’s simpler and easier for one is not necessarily simpler and easier for another. Any system that is regular and punctual has to be better than a system that isn’t… or than no system at all.

Views expressed are always my own and not my employer's, my church's, my family's, my neighbors', or my pets'. The house plants have authorized me to speak for them, however, and they always agree with me.

[Aaron Blumer]G. N. Barkman wrote:

It strikes me that the credit card debate is similar to the alcohol debate. Many people who use credit cards cannot seem to control their spending. Solution, prohibit credit cards. Hmmm

There are similarities. Both should be avoided if possible. But then, only one of them in excess generally leads to traffic fatalities, sexual indiscretions, domestic abuse, job loss, poverty, and liver damage.

No argument with that, though one might point out that the economic situation we’re in IS in fact the result of reckless debt—and the suicide rate has increased about 20-30% in the past decade or so. So there is a body count that seems to correlate nicely with various factors in our country, of which debt is one factor.

However, what I think GN was arguing is not that debt has either the immediate, horrific consequences of alcohol abuse, nor that debt has the chronic, long-term consequences of the same. What he’s arguing is that too often, the church’s approach to debt is the same as that for alcohol—see the bad with its abuse, therefore ban it completely. Obviously, most of us don’t do that with other things which have bad consequences, like television and donuts. :^)

Aspiring to be a stick in the mud.

Discussion