The Church Treasurer: The Transition and Assuming the Role

Image

Twice I’ve had opportunity to manage the finances of another individual. The first was my son Roger’s deployment to Iraq. He was a student at Saint Cloud State and a reservist in the USMC when he was called up and had to deploy. It happened rather suddenly. He and I took these steps:

- We visited his bank and had me added to his accounts

- He reviewed with me his finances and bills and had all directed to my address

- We rented a garage to store his truck

Upon his return,1 all reverted back to him. (I was amazed that his ‘95 Chevy S-10 started with no issues having been stored for almost a year – “Like a Rock”).2

The second time was my 95-year-old Mother’s finances. There must be a bookkeeper’s DNA in our family—Mom was a Methodist church bookkeeper during WW2, my sister is the treasurer of a college alumni association chapter, my daughter is the treasurer of an NGO, and my son is an accountant. My mother was a diligent record keeper. For years she meticulously recorded all her financial inflows and outflows on green ledger paper. In her 90’s she developed what her children call “her decimal problem.” It famously and humorously revealed itself when she told her friends at the nursing home that she only paid 14 cents for her dinners. It created a bit of a kerfuffle as other residents complained to the management that Cleone3 was only paying $.14 while they were being charged $14.00!

It took some time to convince Mom to quit driving (the neighbors complained, and we seized her car when she was hospitalized and sold it when she, in a weak moment, agreed). Likewise, it was difficult to persuade her to sell her home4 and move into a nursing center. The crisis which motivated her to sell was that her friend Virginia fell in her home and lay unnoticed on the kitchen floor for several days before her being discovered by a neighbor. Virginia survived!

After Mom’s dining room decimal debacle, I began to lobby hard to assume her finances. She agreed and I began to plan to become her bookkeeper. It would be just like Roger’s arrangement:

- Get added to her bank account (minor issue: it was a Texas bank and would require a quick trip there to be face to face with a banker).

- Ditto with her Discover card (her only credit card)

- Pay her bills (they were simple: rent, utilities, her credit card and a few others)

- Provide monthly reporting

As things turned out, she passed just as this process was commencing and my role became the estate executor.5

The church Treasurer role is like managing another’s finances in these ways:

- It is a fiduciary responsibility6—the monies are not your own!7

- The church Treasurer only pays the bills authorized by the church and church leadership

- The church Treasurer accounts for and reports on the spending.

There are significant ways that the Treasurer’s role is different in complexity and amplification over managing another’s finances. It is different in these 6 ways:

- Expense categories: Roger’s or Mom’s finances were simple: Income and half a dozen expense categories. Our church has 80 different expense categories.8 Church reporting is granular which assists with planning.

- Budgeting: The second area is budgeting: Roger & Mom didn’t have a budget; our church has an established and approved budget that has to be tracked against.

- Variability of income flows: The third area is variability of income. Roger had a regular and dependable income from the defense department; Mom had her AT&T pension and her social security checks that were as punctual as a Japanese commuter train.9

- Accounting: A fourth area of complexity is double entry10 and fund accounting.11

- Payroll: A church needs to provide regular payroll payments, 941 reporting,12 EFTPS13 payments, and W-2s.14 Additionally there is an Employment Eligibility Verification process, which must be completed by each new hire.15

- 1099 processing: Some vendors and individuals must receive 1099s.16

Suffice it to say that the scale and complexity of church accounting is much more than managing one’s personal finances!17

As for the transition to the Treasurer’s role, there are these similarities:

- Establish the banking relationship

- Understand “the culture” and the history of the role

- Have access to the invoices (that trigger the payments)

- Understand the accounting system18

- Commence the role with a cutover date

Establish the banking relationship

Our church banks with a small community bank. It is headquartered in the town next to us and has a branch within a quarter mile from our church. The first steps taken in the transition were:

- Access to the on-line system

- Becoming a signer on all of the accounts

- Having access to the bill pay function

My impression was that this would be one-step, but it turned out to be a three-step process, with the third the most complex. My predecessor was a bit confused about how this authorization worked and so was our bank contact. Being a retiree of a major national bank, I had an expectation of that level of service from the community bank. As it turns out our community bank’s processing is outsourced19 and so some service issues are addressed in-house and other’s less personally by a third party.20 One advantage of the community bank, is that they charge us no fees—that would not be the case with the major bank in our region.

Understand “the culture” and the history of the role

The steps I took here was to review previous months’ reporting and previous years’ budgets. Also, I attended several months of board meetings and observed how my predecessor reported and the questions she was asked. My predecessor, as an aside, is a dear faithful servant and did a commendable job.

Have access to the invoices (that trigger the payments)

Our paper flow with invoices is as follows: They are received in the mail, sorted by our secretary and placed in the Treasurer’s mail slot. I pick them up on Wednesdays and Sundays and schedule the payments with bill-pay.

I have improved upon this system in several ways. For some vendors, I have web access and receive the invoices by email as well as by mail. I also established a process for our VISA statements. The day after the VISA statement cutoff date, I download the month’s transactions, code them to our church’s COA21 and report this to the leadership.

Understand the accounting system

The church had previously determined to scrap the current software system and commence with the Aplos cloud-based system,22 so my role called for commencing that setup. This activity took place in December 2018, the month before the cutover of January 1 2019:

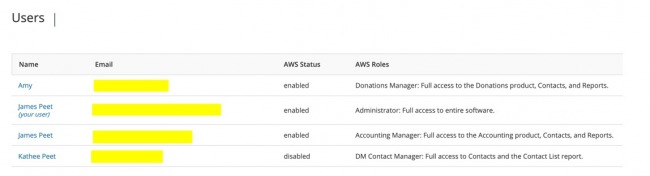

- I established roles in the Aplos system

- I uploaded the current chart of accounts.23

- I populated all of current vendors

- I uploaded all of the donor names, addresses and envelope numbers24

Training

Training was bifurcated. I trained myself on both the Financial Secretary side of the system to enable me to train the Financial Secretary, and I trained myself on the accounting side and leveraged my relationship with Gary Blessman to help me understand fund accounting.

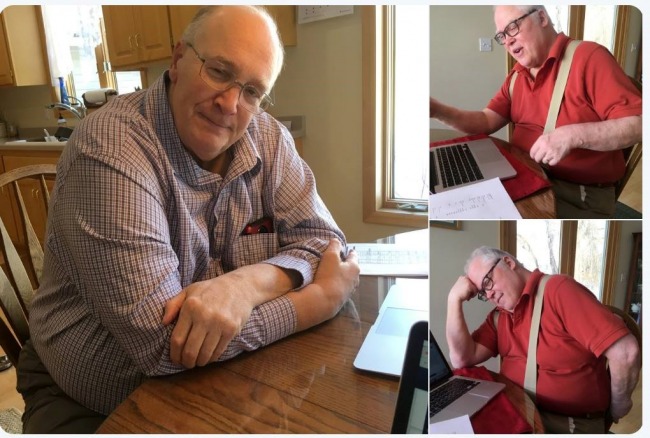

My mentor, Gary Blessman. He is saying “Focus, grasshopper”25

Aplos has a YouTube channel that I found helpful.26 Here’s a helpful tip, the videos can be viewed at double speed. I estimate that I did about 5 hours of training.

Aplos has a YouTube channel that I found helpful.26 Here’s a helpful tip, the videos can be viewed at double speed. I estimate that I did about 5 hours of training.

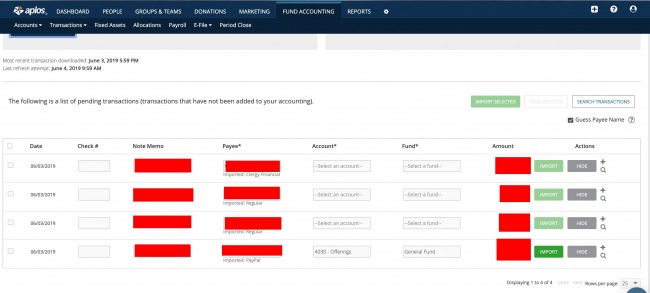

Aplos has a Bank integration system that pulls bank entries and puts them into a queue for coding. I used the month of December as COA test coding.

Aplos has a Bank integration system that pulls bank entries and puts them into a queue for coding. I used the month of December as COA test coding.

On the Financial Secretary side, I created test donors and recorded faux donations. Aplos has a robust batch upload system. I met with our Financial Secretary on a Wednesday night in December to train her and created a batch upload training guide.27

Commence the role with a cutover date

I would be lying to say I had complete confidence that I was up to the task of being the Treasurer and whether I would succeed. As Christmas week ended and January 1 was on the horizon, my fallback position was to announce that I am inept and not up to the job. “Forgive me and have my predecessor do the job.”

I leveraged my son’s time—he was then an accountant with a Fortune 600 American food distributor and grocery store retailer (since promoted to auditor). He provided this simple advice: Take the month end closing numbers from the December 31 statements and enter those as your beginning numbers. My original plan was to use the reported numbers from the balance sheet that my predecessor would be reporting for her month end closing. But that report would not be available on day #1 (January 1) and thus it would postpone the timing of the cutover. As my son and I conversed in mid-December, he noticed that the November balance sheet from the previous accounting software had rounded all of the reporting numbers to full dollar amounts. He said, “Dad you have to have this down to the penny, so use the bank statement amounts.”

So on January 1, I downloaded the bank statements from our community bank and entered the December 31 amounts into Alpos and ran my first Balance Sheet and I was off and running.

I breathed a sigh of relief. I’ve never had a New Year’s Day like that!

Notes

1 https://youtu.be/bsh2Wo48L3U. That’s Kathee exclaiming “I’m so excited!”

2 The commercial, https://youtu.be/2tnvGt2CrGc ; Behind my motive to buy a 2002 S-10 that is my go-to daily driver!

3 Picture of Mom on her 94th, https://coldfusion-guy.blogspot.com/2016/03/i-am-resurrection-and-life-h…

4 Her Towerwood home, https://coldfusion-guy.blogspot.com/2013/05/moms-house-goes-to-market.html

5 Addressed in “The Stewardship of Final Affairs”, https://sharperiron.org/article/stewardship-of-final-affairs-part-2

6 https://www.aplaceformom.com/blog/4-08-16-misconceptions-about-a-power-o…, “a fiduciary … make(s) decisions that are in the best interests of the principal”

7 An ancillary principle is that he does not write checks to himself. He may have a need of some supplies, but the best way to handle this is to have the secretary or deacon purchase the supplies for the church.

8 A helpful article on the non-profit’s chart of accounts is here: https://www.aplos.com/support/articles/nonprofit-chart-accounts/

9 Trains in Japan are incredibly punctual. Being on time is counted down to the centiseconds. https://kotaku.com/ever-wonder-why-japanese-trains-arent-late-heres-why-…

10 https://en.wikipedia.org/wiki/Double-entry_bookkeeping_system. My approach for my own personal finances is “single-entry.”

11 It’s a bit confusing but important to understand: https://www.donorsearch.net/fund-accounting-fundamentals/. Note: “It is not necessary to create separate bank accounts for the cash attributable to a fund, especially when all of the organization’s cash is in a single bank account. The only thing that comes out of this is extra work.”

12 See About Form 941, Employer’s Quarterly Federal Tax Return: https://www.irs.gov/forms-pubs/about-form-941. The companion to this is the EFTPS.

13 EFTPS, The Electronic Federal Tax Payment System. https://www.irs.gov/payments/eftps-the-electronic-federal-tax-payment-sy…. This system is also used by individuals that pay estimated taxes.

14 The companion is the W-4: https://en.wikipedia.org/wiki/Form_W-4

15 See Forms You Must Have New Employees Complete at Hire: https://www.thebalancesmb.com/forms-you-must-have-new-employees-complete…

16 See “How to Determine Who Receives a 1099”: https://blog.fabeancounters.com/bean-blog/how-to-determine-who-receives-…

17 Consider this anecdote: I recently bought some toys for the grandkids. I only had to tell my wife! https://www.hammacher.com/product/giant-polydron-fort-kit

18 By “system” I do not mean “the software.” For some churches it may be a manual paper process. For others Excel spreadsheets. For our church it is non-profit software.

19 https://en.wikipedia.org/wiki/Jack_Henry_%26_Associates. My wife, who is a retired bank IT manager has extensive experience with Jack Henry through multiple bank acquisitions. What should have been one call to one source ended up being multiple calls.

20 Likewise our church’s VISA card, although branded with the community bank’s logo, is outsourced to a major regional bank.

21 See “How to Set Up a COA for your church,” https://www.aplos.com/academy/church-management/set-chart-accounts-church/

22 Addressed in my previous article here, https://sharperiron.org/article/church-treasurer-from-kluge-to-cloud

23 I had to normalize our COA because some of our account “numbers” weren’t numbers at all. Some had hyphens for example. Aplos was needing integers. I created a cross-table from the old to the new COA system.

24 I deputized my wife who spent several days entering donor data to be used by the financial secretary.

25 https://youtu.be/jWctNoTXrGw

26 The Aplos training YouTube channel: https://www.youtube.com/user/AplosAccounting

27 Batch upload training guide: https://smallchurchtreasurer.blogspot.com/2019/04/batch-import-of-donati…

Jim Peet Bio 2016

Jim is a retired pastor and a retired IT professional. He volunteers at Central Seminary.

- 329 views

Intended for above this line: “My mentor, Gary Blessman. He is saying “Focus, grasshopper””

Good to see you and Gary looking well! Thanks for the profile here.

Aspiring to be a stick in the mud.

Added the images. There are some format challenges since we don’t usually have wide images, but hopefully they look OK on most screens.

Views expressed are always my own and not my employer's, my church's, my family's, my neighbors', or my pets'. The house plants have authorized me to speak for them, however, and they always agree with me.

Discussion