Ordering Finances Wisely, Part 7: Becoming Debt-Free

Image

Read the series so far.

Why are credit card fees and interest so high?

Credit operates using basically a two-tier system. Tier 1 consists of those who pay no fees or interest. Consumers who pay off their balances on-time monthly pay no fees or interest charges. Tier 2 consists of those who pay fees and interest due paying late, not paying the minimum payment or due to carrying a balance and being charged interest. Tier 2 credit card customers not only pay for their own credit card service, they also pay for the credit services of those in Tier 1.

Any customer may be a Tier 1 borrower. Falling into the Tier 2 category is the customer’s choice.

Another reason for high credit fees and interest is that there is expensive technology infrastructure in place to support the service. The infrastructure includes network expense and computer hardware and software expense. It also includes real-time processing with failover—the most expensive type of computer processing. Additional infrastructure expenses include fraud detection processing and the cost of plastic production and the associated mailing.

A variety of other factors drive the cost of credit cards. Substantial phone bank support is usually offered. Additional services such as price protection, rewards, rental car accident insurance, fraud protection, etc. increase costs. And the nature of the debt itself a cost factor because credit card debt is unsecured debt. In the case of bankruptcy, collateralized debt takes precedence. “Under risk-based pricing, creditors tend to demand extremely high interest rates as a condition of extending unsecured debt.” Those with lower credit scores pay a larger share of the debt costs because they have a greater propensity (risk) of not paying off the debt (see Calculation of Interest Rates).

The credit card industry is also very competitive. Credit card interest rates are not affected by monopoly or oligopoly pricing models. Bankrate.com is an example website that provides a comparison of credit card rates.

The peril of the minimum monthly credit card payment

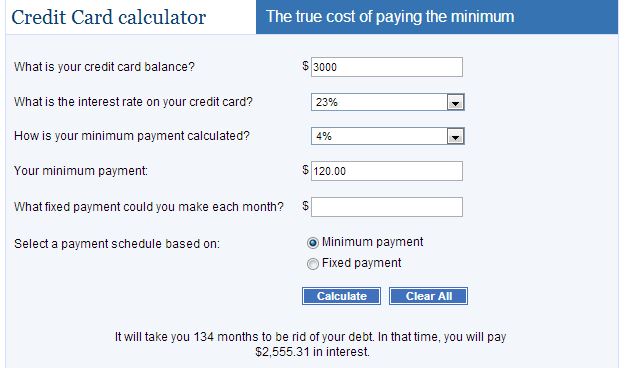

How is the minimum monthly credit card payment calculated? There is no simple answer to this question. Not every credit card company uses the same model. Bankrate.com suggests that it is generally 2% to 4% of the statement balance. Bankrate.com also provides a calculator.

The following example uses a $3000 balance, a 23% interest rate, and a minimum payment of 4%. Paying the minimum balance, it will take the consumer more than 10 years to pay off the debt and over those ten years, the consumer will pay over $2,500 in interest payments.

Strategies: consolidating with a replacement debt instrument

One approach to solving credit card debt problems is to consolidate and combine the card debt and fund it with a replacement debt instrument at a lower interest rate. Options for the replacement debt instrument include these:

1. Home equity

This strategy is to take out a Home Equity Line of Credit (HELOC) using the value of one’s home. Obviously this is only available to homeowners, but also only to homeowners who have equity in their home. The strategy is to draw money from the HELOC, pay off the credit cards completely, then pay off the HELOC over a period of time.

- A HELOC interest rate may be as low as the prime rate plus a certain number of points.

- The cost savings can be dramatic.

- The weakness of this approach is that the consumer is opening up a new credit line. The unsecured debt of the credit card is turned into collateralized debt (backed up by the title to the home), and if the consumer is undisciplined and continues to abuse credit card debt and fails to pay the HELOC debt, he is in danger of losing his house to foreclosure.

2. Peer to Peer Lending

Peer to Peer lending connects consumers who wish to lend with consumers who wish to borrow. The bank or financial institution middle man is omitted. The two major Peer to Peer lenders are Lending Club and Prosper. Note that:

- Peer to Peer borrowing is unsecured, so the undisciplined consumer is not at risk of losing his home to foreclosure. Additionally this avenue is available to renters.

- Interest rates are not as low as the HELOC option, but they are generally much better than credit card rates.

- This option includes the danger of opening up a new credit line. The consumer without discipline can actually increase debt.

3. Zero interest cards

Another strategy is to transfer debt to a new credit card with a zero interest temporary period. The consumer will use the zero interest period to pay down debt. Again a danger exists in opening a new credit line; without discipline the consumer will just rack up more debt and dig himself deeper. Bankrate.com is a good resource for finding introductory zero interest cards.

Strategies: paying down debt without opening new lines of debt

1. The “snowball” approach

This approach is to continue making minimum payments on all debt, but pay off the smallest credit card balance first. Once that debt is paid off, continue to the next largest and continue that sequence until all credit card debt is paid off.

The advantage to this approach is that it enables the consumer to see results and experience success early—“The point being, that when a debt is paid off, even the smallest one, the fantastic feeling of accomplishing this will be enough to spur you on to keep going” (Our Debt Ladder). A resource for this strategy can be found at Disease Called Debt.

2. The “Ladder” approach (also called a “better snowball approach”)

In this approach, while maintaining minimum payments on all debt, pay more to the most expensive debt (higher APR) first. A resource for the ladder approach can be found at Paying Off Debt: 6 Steps to Building a Better Snowball.

3. Credit Card debt negotiation

See Credit card debt negotiation in 3 (not) easy steps).

4. The “stacking” approach

Normally consumers have to work with a credit card counseling service to negotiate this arrangement. It is best explained using an example: If a consumer has 3 credit card relationships and can only afford to pay $500 per month towards credit, an agreement would be put in place to pay only the $500, and that payment would be divided up among the three creditors.

Resources for Credit Card Counseling

Note that there are non-profit resources and for-profit resources. The following resources are non-profit:

- National Foundation for Credit Counseling

- The Department of Justice searchable database of approved credit card counselors.

- The Federal Trade Commission resource on Credit Card Counselors.

- Consumer Reports—How to Pay Down Your Debt

What about bankruptcy?

Briefly, because this topic is beyond the intended scope of this article, bankruptcy is a last resort. A credit counselor I interviewed advised me that if wages are being garnished and if one is unable to put food on the table, bankruptcy should be considered.

Must one aim to be debt free?

I follow the good-debt, bad-debt model that I presented in an earlier article. I suggest that it is a worthy objective to never carry credit card debt—that is to achieve the discipline of paying one’s credit card balances off completely upon presentation of the statement.

It’s my own preference to become debt free (and I have achieved this). Ultimately every consumer will be debt free—even if they die with debt—because the executor of one’s estate will have to deal with every debt in probate.

Jim Peet Bio 2016

Jim is a retired pastor and a retired IT professional. He volunteers at Central Seminary.

- 10 views

Discussion