Ordering Finances Wisely, Part 5: The Personal Income and Expense Statement

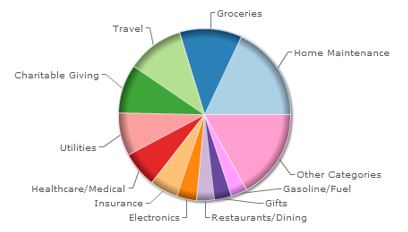

Image

Read the series so far.

In various phases of life I have spent money without giving much thought or planning to it. The first was when I was in seminary and I had to have the latest book. A professor would mention a book and I would have to have it. Another was when I bought my first CD player. The first CD I bought was an Herb Alpert’s Tijuana Brass album. I soon thought I had to have a library of CDs. The third time was when I bought our first DVD player. First, it was “Lawrence of Arabia,” then many more followed. Another phase—and this probably sounds like “true confessions”—is when I had to have the latest modem (2400 baud) or software (Word Perfect) or hard drive.

A single CD, or book, or DVD, or device is not much of a problem, but unchecked anything becomes a spending issue. My wife, who handled our finances during these phases, put up with a lot! Many counselors can testify that finances are a major cause of marital strife. A secular study from 2009 attempted to quantify the effect finances had upon marriages:

Of all these common things couples fight about, money disputes were the best harbingers of divorce. For wives, disagreements over finances and sex were good predictors of divorce, but finance disputes were much stronger predictors. For husbands, financial disagreements were the only type of common disagreement that predicted whether they would get a divorce. (New York Times)

I observe that it is important to know where and how much one spends. And it is important to know one’s income. This brings us to the personal income and expense statement.

Round One—off the top of your head!

There are forms available on the Internet for this and indeed one may easily use an Excel spreadsheet to create this statement, but I suggest first that you create one off the top of your head—you won’t be that accurate but you can check for accuracy later. If you are single this will be a lot easier but if you are married this will be more fun. Gather your spouse and ask some simple questions. And write down the the answers:

Income

- What is your take home pay? How frequently are you paid? (Don’t try to record taxes and other deductions; keep it simple: just the take home pay!)

Expenses

- How much is the rent (or mortgage)?

- What are the average utility costs (water, electric, gas, and garbage)?

- How much spent on clothing? Restaurants? Child care? Gas? Car maintenance?

- Move on to the other areas: CDs (or MP3s)? DVDs (or streaming)? Books and magazines?

Savings

- How much are we saving?

- Is it automatic?

Charitable donations

- Is there a plan?

- Or what is left over?

- Or do you give emotionally—if you ‘feel like it’?

An obvious truth: you cannot spend more than your income. You may for one month, but you cannot spend more than your income month after month without consequences.

The income (or income and expense) statement records your income and expenses for a particular period in the past. It is different from a budget that projects or plans income and expenses for a period in in the future. You cannot accurately budget for the future until you have successfully and accurately tracked your income and expenses in the past.

The income and expense worksheet is the standard method to track cash inflows and outflows. Multiple examples are available on the Internet and any of of them is probably as good as another (an example).

Round Two—thoroughly document last month

This will take some time. Gather the documents: credit card statements, cash receipts, checkbook statement. Account for every penny! There may be an “aha moment” here where there is a sudden realization that you spend a lot more on a certain item that you think. Document everything! Did your income exceed your expenses?

Round Three—thoroughly document last year

This will take more time. The process is the same.

Isn’t there an easier way?

- There are popular software programs that enable one to track expenses (and income). Income is really the easy part because over the course of a year one will probably have 26 or 52 paychecks. It’s the expenses that are difficult.

- Cash is the leaky bucket. Suppose you take $40 out of the ATM every week—where does that money go?

- Another quick way is to use an account aggregator website such as Mint or Yodlee. These work by one adding various bank and credit accounts to the service. The aggregator service will pull account data and attempt to automatically categorize the expenses. It’s not perfect but with both of the services above, users can adjust the automatic categorization to the appropriate categorization.

An Example

Our practice

I used Quicken for more than 20 years. Four years ago I began to use Yodlee. I like Yodlee because:

- There is no software to purchase;

- I can view and use it on any computer (Mac/Linux/Windows) and location (home or work);

- I export data for a period (say a year) and import into Microsoft Access for more thorough analysis.

Jim Peet Bio 2016

Jim is a retired pastor and a retired IT professional. He volunteers at Central Seminary.

- 50 views

Another online program that was recently featured in a Wall Street Journal article is Learnvest.

It has an income and expense component. it is not free.

healthcare/medical slot in the “pie” is WAY too small!

John Uit de Flesch

From this worksheet:

http://financialplan.about.com/cs/budgeting/l/blbudget.htm

We do not track:

- Federal income withholding taxes

- State income withholding taxes

My practice to to have a little more withheld then anticipated taxes at April 15th time. Our paystubs (as is common) keeps a running total of these amounts. Not a factor in “Spendable Income”

We also do not track (with the reasons):

- Interest income (because for us it is relatively small & it just goes back into the savings account. So it is not a factor in “Spendable Income” AND

- Investment income (because it is held in investment accounts and reinvested. At this juncture not a factor in “Spendable Income”

A helpful tool: IRS Withholding Calculator

Those who under-withhold, will face a tax bill at tax time.

I use Mint.com, but I also like a simple table I made in MS Word which lists our household budget by category. I update it each week and finalize it at the end of each month to see how our budget fared, and where we need to make cuts or be cautious.

Tyler is a pastor in Olympia, WA and works in State government.

I use the envelope system per Dave Ramsey. According to him paying with cash hurts more so people spend less. As long as you are working out of a specific budget you should have no trouble. Our bills are still on auto-pay but everything else is cash.

After a long struggle with cash flow issues in our family, we went mostly to a system where regular bills (all the steady predictable stuff) is paid electronically and just about everything else is cash.

The advantage is that there is less bookkeeping overhead to know when your funds are getting low… and when they’re gone.

The downside is that you can’t precisely track where it all went without making a study of receipts. But if you log every expenditure, you’re really making a study of receipts anyway. Taking out cash in one or two largish withdrawals can also facilitate an envelope system if you want to divide it up for specific purposes.

(Another account gets a bit out of each paycheck to accumulate for those inconvenient quarterly and annual bills… and the odd “didn’t see that coming!” also, hopefully)

Not a perfect system but it works OK most of the time.

Views expressed are always my own and not my employer's, my church's, my family's, my neighbors', or my pets'. The house plants have authorized me to speak for them, however, and they always agree with me.

Cash for us - about $ 60 per month / we use CC’s for 2 reasons:

- Points

- Recording of expenses

It strikes me that the credit card debate is similar to the alcohol debate. Many people who use credit cards cannot seem to control their spending. Solution, prohibit credit cards. Hmmm

G. N. Barkman

- 6% Cash Back at U.S. supermarkets up to $6,000 per year in purchases (then 1%)

- 3% Cash Back at U.S. gas stations;

- 3% Cash Back at select U.S. department stores; and1% Cash Back on other purchases.

There’s a $ 75 annual fee

We spend approx $ 6000 per year on groceries = $ 360 per year cash back

We spend approx $ 2500 per year on gasolene = $ 75 per year cash back

I use Bank of America Cash Rewards Visa, which also pays cash back, though smaller amounts than Blue Card. There is no annual fee. I get several hundred dollars back each year. My wife uses a BP Gas Visa (I forget which bank), and saves huge dollars every time she buys gasoline. She can sometimes fill up her Toyota Sienna for a couple of dollars because of the rewards discount at the pump. When wisely utilized, credit cards can pay big time! We pay our full balance each month to avoid interest charges, late charges, etc. Our credit cards cost nothing, and pay us many hundreds of dollars each year.

G. N. Barkman

[G. N. Barkman]It strikes me that the credit card debate is similar to the alcohol debate. Many people who use credit cards cannot seem to control their spending. Solution, prohibit credit cards. Hmmm

There are similarities. Both should be avoided if possible. But then, only one of them in excess generally leads to traffic fatalities, sexual indiscretions, domestic abuse, job loss, poverty, and liver damage.

Views expressed are always my own and not my employer's, my church's, my family's, my neighbors', or my pets'. The house plants have authorized me to speak for them, however, and they always agree with me.

[Aaron Blumer]G. N. Barkman wrote:

It strikes me that the credit card debate is similar to the alcohol debate. Many people who use credit cards cannot seem to control their spending. Solution, prohibit credit cards. Hmmm

There are similarities. Both should be avoided if possible. But then, only one of them in excess generally leads to traffic fatalities, sexual indiscretions, domestic abuse, job loss, poverty, and liver damage.

…..imprudent use of the other, resulting in excessive & unmanageable debt, can lead to stress-related health problems, marital strife, domestic abuse, divorce, bankruptcy, poverty, theft (embezzlement, fraud, etc.), job loss, and even suicide.

Why? If one demonstrates that he can manage them advantageously, why should another say that they should be avoided? Perhaps I should say that failing to use credit cards wisely, and forfeiting the potential hundreds of dollars of annual rewards is wrong? But then, I am not inclined to require something that is clearly a matter of liberty. Why do some Christians feel the need to try to regulate every area of another’s life?

G. N. Barkman

I regularly use one credit card, which has a $39 annual fee, for normally incurred expenses (gas @ the pump, weekly groceries, etc.). For some types of purchases, I get double points.

The issuer of this card has never received a penny in interest from me; I always pay the balance in full each month.

In the past 15 years or so (since I got this card), I’ve flown round-trip three times using points (including from Minneapolis/St. Paul to Honolulu & back), redeemed points for hundreds of dollars in retail gift cards, enjoyed a 3-night stay on Lake Superior (just last May; this would have been $149 per night had I paid for it), and other rewards benefits.

Annual fee notwithstanding, I’ve received far more in points redemptions that the cumulative annual fees paid.

Discussion