The Qualifications for the Church Treasurer – “Dr. No”?

Image

Read the series.

I mentioned Gary Blessman in the first article in this series. Gary is the Vice President of Institutional Finances1 at Central Seminary and the Business Administrator2 at Fourth Baptist Church and Christian Schools.

Jim Peet is no Gary Blessman—I will never be a Gary Blessman! But my church is not Fourth Baptist Church, and we don’t have a seminary. An organization like Fourth Baptist Church and Central Seminary needs a professional treasurer—ideally someone who is a C.P.A. and has an accounting degree. Gary graduated from the University of Southern Colorado with a degree in accounting, and from Southwestern Baptist Theological Seminary with a Masters in Church Administration. He passed his C.P.A. exam in 1987. He was the bursar at University of Wisconsin-Green Bay and the controller at Mount Senario College before joining the staff at Fourth Baptist Church. He has the requisite education, and experience for his ministry.

The treasurer of a large church deals with issues “beyond my paygrade”3 such as:

- Negotiating mortgages

- Managing a large number of assets such as a vehicle fleet, properties, computers and servers

- Overseeing a large payroll

- Administrating an investment account

I actually had coffee with Gary this morning and we chatted briefly about the qualifications for a church treasurer. Others were around the table as well and they will remain anonymous, but in jest someone said that the church treasurer is “the only adult in the room” because of the lack of financial literacy among the populous.4 The conversion turned a bit silly and another suggested the title I adopted for this article: “The Church Treasurer—Dr. No,”5 suggesting that the treasurer is a brilliant accountant with a Napoleon complex. He is the one who tells the spiritual leadership of the church that they “can’t afford it”—“No! … No! … No!”

This series is not so much addressed to the professional treasurer but rather to the volunteer treasurer.

Obviously, the qualifications of a non-profit/church treasurer should mesh with and match the responsibilities addressed in my previous article.

Nerida Gill6 of Admin Bandit suggests these seven traits of a good volunteer treasurer:

- Integrity: Integrity means various things to different people, but at its heart, to have integrity means that you are honest, dependable and trustworthy. It is the number one trait that treasurers … should have.

- Patience: As treasurer, you will be called on to simplify complex financial information and translate it for others that don’t have extensive backgrounds and experience with accounting and finance.

- Persistence: To fulfil their oversight role, treasurers must be ready to follow the trail of their [predecessors’] financial moves. They need to be able to look through the records of former treasurers and be prepared to deal with the unexpected, including changes in accounting practices that have affected the way that specific valuations are determined and accounted for.

- Availability: While automated bookkeeping software has simplified many of the most basic, time-consuming and monotonous accounting tasks for treasurers, there are still many duties that require the treasurer to be available.

- Comfortable Dealing with Numbers and Handling Cash: While it’s not necessary to have a specialised degree in accounting or bookkeeping, or have direct experience in the financial sector, it can definitely help. Regardless of their previous experience, a good treasurer will be comfortable with figures, as well as handling large amounts of cash. They are prepared to enter transactions, especially those that affect nonprofit monies, as soon as possible. They “play by the rule,” and are responsible and do not disburse funds without board approval and require proper documentation before making disbursements.

- An Analytical Mind with an Eye for Details: A good treasurer is also someone who tends to be very practical. They can analyse problems, zero in on the fine details, and perform tasks in a very planned, methodical manner. Being able to think, plan and act logically helps them to spot discrepancies and trace them back to the source, whether the source is a simple human or computer error or a deliberate act, such as an instance of internal theft or another form of fraud.

- Ability to Act Decisively and Impartially: The best treasurers are always able to separate their personal feelings about a person or proposal, from their professional, legal duties. They can thoroughly analyse the facts around a situation and make impartial decisions that are based on what is best for the nonprofit and the population it serves.7

Along the lines of “playing by the rules,” the successful church treasurer will be versed in the church’s Bylaws—“A firm understanding of the organization’s bylaws will ensure you maintain the finances to the standard of the organization’s rules.”8

Property Management company, First Service Residential, addressing the HOA board treasurer advises:9 “Although the entire board has a fiduciary responsibility to the community and makes collective decisions about budgeting and investments, the treasurer must analyze and understand financial information and explain it to the rest of the board.”

While I’m not comfortable calling the spiritual leadership of a church—that being elders and deacons—“a board”; nevertheless, the point made about “fiduciary responsibility” is valid for the church treasurer.

Another qualification for a successful church treasurer is foresight. This is really true for the treasurer of any organization: “A good treasurer should be looking at least five years out.”10

On a personal note, this is one of my strengths. Perhaps I developed this trait in my secular career but planning, forecasting, project management, and calendaring come naturally for me. For example, I have a project spreadsheet for our home with months and dates when I anticipate replacing the air conditioner, the furnace, repainting various rooms and a long-term remodeling plan. The church treasurer must be thinking ahead like a chess player: when will the parking lot need to be replaced, what might the rent be next year, etc.

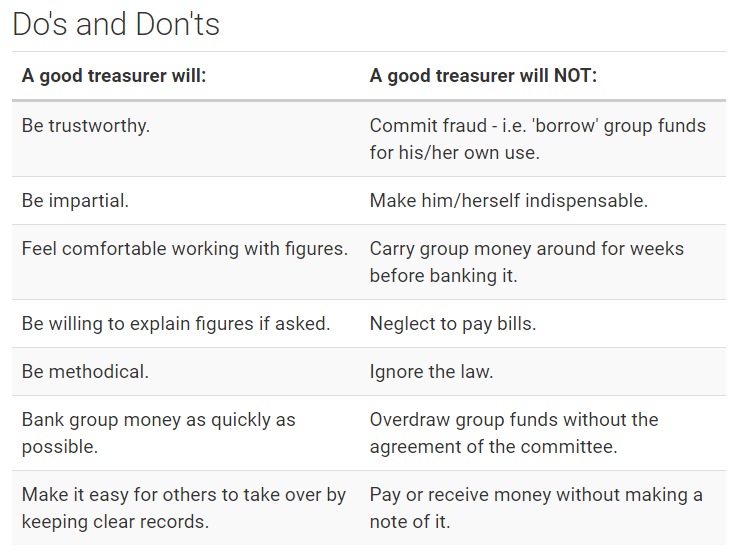

The Do It Yourself Committee Guide provides these dos and don’ts.11

Spiritual Qualifications

I find the above qualifications helpful but lacking as to the specifics of being a church treasurer. I believe the Scriptures guide us.

1. Firstly, the church treasurer is a ministry with spiritual qualifications.

The treasurer is foremost a steward. The monies are not his to spend. Ultimately the Lord owns all of the church’s assets. I don’t see that the treasurer should have “apt to teach” standards but the bishop/deacon standards should be held by the treasurer. Some churches elect the treasurer from among the deacons. I was in a church where a godly woman served as the treasurer. While not specifically called an elder, my friend and mentor Gary is on the pastor’s staff at Fourth Baptist.

2. I see that I must have a passion for the Lord’s work and for my local church.

My agenda must be the church’s agenda! I aim to personalize Matthew 28:18-20 and make this my mission. I don’t want to be known as “the money man”!

3. Additionally, I see myself as under the leadership of my pastor and the deacons.

Just this week, I told the men that the church and they decide on how the monies are spent and I write the checks. It’s not my money and it’s not my decision. It’s simple for me!

4. My desire is to abound in giving.

It would be perverse to be in this role and be a greedy piker. I view Nehemiah and Phoebe as examples:

- Nehemiah was generous, had a servant’s heart and did not make monetary demands on the work. Nehemiah 5:14-19.

- Phoebe (Romans 16:2) was apparently a woman of wealth and was a “patron” (ESV),12 or “benefactor” (NIV), of the church.

Practical Qualifications

Aside from what I argue are spiritual qualifications, I posit these practical qualifications:

1. Advice: conduct a criminal background and credit check on a prospective treasurer.

My church is small and did not conduct this check in me; but using Minnesota based Trusted Employees, they did do a criminal background check on my wife before she was permitted to serve in the nursery. Would I have minded? Not at all! On the credit check, if one cannot manage his own finances, what assures the church that he can be a successful treasurer?! On the criminal background check, consider that Church fraud exceeds what churches give to missions.13 One would think that the Separation of Duties discussed in the previous article would address this. But churches can over-trust! 65-year-old Andrew Matheason established a fictitious company and wrote checks from the church’s bank account made payable to that fake company. He also set up electronic transfers of funds from the church’s accounts to pay his personal credit card balances. To avoid detection, Matheason created false financial reports and presented those false reports to church leaders.14 AGFinancial Solutions recommends the churches conduct background checks and run credit reports on those handling church funds.15

2. The church treasurer may need to function as the proverbial “adult in the room”!

The Forbes article cited16 above reports that America has A major financial literacy problem. Another Forbes article17 states “One of the silver linings of the financial crisis was that it was supposed to have taught many Americans a lesson, albeit painful, about the dangers of debt, and financial issues in general. Apparently, the message, though, didn’t get across. All told, a new study, which was released today, estimated that nearly two-thirds of Americans couldn’t pass a basic financial literacy test, meaning they got fewer than four answers correct on a five-question quiz. Worse, the percentage of those who can pass the test has fallen consistently since the financial crisis to 37% last year, from 42% in 2009.” I hypothesize that ⅔ of the average church members and ⅔ of the pastors in Christian churches are likewise financially illiterate. God forbid that the church treasurer be among the ignorant!

Furthermore, Americans are addicted to debt: credit card debt,18 student loan debt,19 corporate debt20 and state21 and federal governmental debt.22 Churches likewise can over-rely on debt: “We’ve seen churches take on debt as much as six times their annual giving. The mortgage payments left very little room for paying staff and expanding ministry.”23

3. The church treasurer needs to be particular about details and be organized. It’s easier today than ever. I use these tools:

- Email:

- I use a separate Gmail account for all Treasurer-related communications. All emails are retained and are easily searchable. Also having a dedicated email for the treasurer keeps my own personal email separate and more manageable.

- I have an email account for encrypted communications. Because the W-4 has the employee’s social security number, I used this for our payroll communications where the W-4 had to be emailed to me. Additionally, when I set up payroll, the employees’ bank account code was needed. Encrypted email protects sensitive data. Protonmail was my choice (I chose the free option). Hushmail is another possibility.

- Our church uses Dropbox for all files for the Pastor-deacons. More detail on this in a subsequent article, but I provide monthly:

- The Income & Expense statement

- The Balance Sheet

- The VISA statement

- A transaction report

- All bank statements (our church has multiple bank accounts)

- There is a folder for each month of the year

- I have my own Microsoft Office 365 cloud filing system:

- I have a more detailed filing system for my own records that is what I provide the leadership plus virtually anything that comes my way that can be scanned and saved

- This minutia will support every decision I’ve made and provide the basis for the annual audit

- For a perspective on the level of detail involved: 3 months into my role that’s over 100 files and 27MB

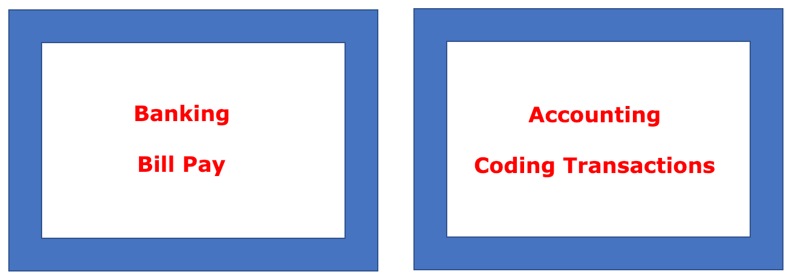

4. The church treasurer needs to be savvy about banking and accounting

This seems to be a given. In essence the treasurer role has two broad elements as illustrated:

Here we see the contrast between one who manages his own finances. At my home, I pay the bills but do not have a chart of accounts to track expense outflow or income inflow (one could … I do not).

Must one be an accountant? I’m not, but it would help. My son, who is an accountant, helped me set up our accounting system for the year start.

5. The church treasurer needs to have more-than-basic PC skills and a good computer.

If accounting is my weak skill area, computers are my strength. Helping me is years of experience with computers and a computer degree. I use a MacBook and have a standby Lenovo Windows 10 laptop. I also have an HP all-in-one printer, scanner and fax. I did not procure the HP for the job, but it has been a real help. I also have a PDF editor that enables me to annotate PDFs.

6. The church treasurer needs to there most services.

I’m at most services. I did miss three services this winter because of snow. Why is it important to be at church? (Aside from the obvious commitment to a local church!). The answer is in paper flow. Bills are received and put into the treasurer’s mail slot. One of the first things we do upon arrival is to pick up all of the invoices (my wife, Kathee, has a large tote) to bring them home to be processed—miss a service, miss an invoice, and a missed invoice could result in a late payment.

I trust that as local churches recruit treasurers that this article would serve as a practical help for church leaders.

Notes

1 https://centralseminary.edu/faculty-and-staff/gary-blessman/

2 http://fourthbaptist.org/leadership/

3 MacMillan Dictionary, “Above my pay grade”: “involving a higher level of responsibility than I have.”

4 Forbes, “4 Stats That Reveal How Badly America Is Failing At Financial Literacy,” April 3rd, 2018.

5 See “Dr No,” Cultural References; https://en.wikipedia.org/wiki/Julius_No.

6 HerBusiness.com “Nerida Gill.”

7 Adminbandit’s Weblog: “Characteristics of a Good Volunteer Treasurer.”

8 Stephen King at GrowthForce: “You Just Became a NonProfit’s Treasurer. Now, What Should You Do?”

9 First Service Residential, “What Makes a Great Board Treasurer? 6 Things You Need to Know.”

10 Ibid.

11 DIY Committee Guide, “Characteristics of a Good Treasurer.”

12 The Greek προστάτις is a hapax legomenon.

13 Brotherhood Mutual, “Church Fraud Exceeds What Churches Give to Missions.”

14 U.S. Attorney’s Office, Northern District of Iowa, “Former Church Treasurer Pleads Guilty to Defrauding Church of Nearly a Half-Million Dollars.”

15 AG Financials, “Stealing God’s Money: Church Fraud Exposed.”

16 Forbes, “4 Stats That Reveal How Badly America Is Failing At Financial Literacy.”

17 Forbes, “Nearly Two-Thirds of Americans Can’t Pass a Basic Test of Financial Literacy.”

18 WRAL, “Americans addicted to their $1 trillion in credit card debt.”

19 Forbes, “JPMorgan CEO Jamie Dimon Calls Student Loans ‘Significant Issue.’”

20 Seeking Alpha, “The Corporate Debt Crisis.”

21 Example is Illinois—Illinois Policy, “$203 Billion and Counting: Total Debt for State and Local Retirement Benefits in Illinois.”

22 The Balance, “The Surprising Truth About the US Debt Crisis.”

23 Tony Morgan, “29 mistakes Churches make with money.”

Jim Peet Bio 2016

Jim is a retired pastor and a retired IT professional. He volunteers at Central Seminary.

- 879 views

….as I am personally wondering when the kerfuffle over finances at Harvest Bible Chapel is going to cease to be their matter and that of the ECFA, and when secular authorities might get very interested. We ought to take heed lest we end up in the same place.

Aspiring to be a stick in the mud.

I gather that … the author is:

- The non-professional treasurer

- Who volunteers (and is not paid)

- Is writing for the audience of the same (non-professional / volunteer)

The Harvest Bible Chapel case and similar issues… Well, the law has gotten involved in church fraud/embezzlement cases many times, as some of Jim’s links show. The key issue is whether the handling of the fund merely violates internal rules and/or ethics or whether it violates civil or criminal law. If there’s a civil law issue, someone would have to sue for damages.

@Dave, yes, Jim is a volunteer treasurer.

There’s a lot of insight there, but I don’t quite share his view that the treasurer should try to be/have to be “the adult in the room.” Fiscal ignorance is often a serious problem, but if we believe in congregational government, the treasurer is not Dr. No. He or she doesn’t even have to be a planner at all. This is the responsibility of the church leadership and ultimately the entire congregation. I would suggest that if the treasurer finds himself/herself in a situation where the church leaders and the congregation are too financially uninformed to make good decisions, he or she should look for ways to become the church’s financial educator… with the goal that they can all make good choices together.

Maybe advocate for having the pastor and elders/select deacons attend some seminars or do some online training. On top of all the rest of it, I wouldn’t want to burden the typical volunteer treasurer with decision-making leadership.

Views expressed are always my own and not my employer's, my church's, my family's, my neighbors', or my pets'. The house plants have authorized me to speak for them, however, and they always agree with me.

I would agree with Aaron that ideally, the treasurer should not be the only adult in the room, but I would conversely say that the treasurer—really the director/pastor of any ministry, or other ministry leaders—ought to be ready at some point to say to the leadership “these are the likely consequences of following this course of action” and “if that’s truly the way you want it, I’m resigning.” In extreme circumstances, the response might be “I’m resigning, and quite frankly, I’ve got to warn those around me of the likely consequences of this action”.

Put differently, congregational church government assumes congregational input, and that in turn gives ministry leaders a certain responsibility to speak up regarding some of the topics they’ve learned well. Two big areas this exists are for the treasurer and those heading children’s ministries. In my life, I’ve been the one to warn “hey, we’re assuming 10% growth in donations with our budget—I don’t know that we can plan this in!” and “the changes in the children’s safety policy made by the deacons could end up putting our pastor or others in jail.” Thankfully, in neither case did I need to threaten to leave or worse.

Aspiring to be a stick in the mud.

Dr. No sent a minion to place a huge, evil spider in James Bond’s room. I fear Dr. No.

Tyler is a pastor in Olympia, WA and works in State government.

Our treasurer recently informed the board of several areas where he felt there was inadequate cost control.

I must add that the minion who deposited the spider was Dr. Strangways, the geologist. The spider failed, and Bond killed it with his shoe. Later, Strangways attempted to kill Bond again. He crept into Bond’s room and fired six rounds at the bed. However, the bed was empty. Bond was actually lying in wait, sitting in a chair beside the door. He killed Strangways. Shortly afterwards, he embarked on his journey to Crab Key and his fateful encounter with Ursella Andress . .

Tyler is a pastor in Olympia, WA and works in State government.

Discussion