Ordering Finances Wisely, Part 6: Helping Another in Financial Crisis

Image

Read the series so far.

Pastors and other leaders are often faced with helping others in personal financial crisis. The crisis may take several forms:

1. job loss whether by layoff or firing

2. a major medical crisis

3. debt at the tipping point

4. divorce or other family crisis

5. death of a spouse or family member

6. societal economic crisis with widespread impact

Job loss, whether by layoff or firing

The income flow stops (as in the case of being fired) or will soon stop (as in the case of a layoff) but the outflow does not. Single income homes are more susceptible to financial impact because the second income of a spouse may cushion the blow.

The financial crisis of this last decade has resulted in widespread job loss1 with young adults particularly hard hit.2 Often layoffs may be anticipated through news reports of one’s company’s financial results. Additionally in many cases there will be rumors at work that “a layoff is coming.”

In the United States, unemployment payments are available for laid off employees, but fired employees are often ineligible for unemployment payments.3

A major medical crisis

For the worker, a medical crisis may result in lost wages. I have some personal experience with this, having missed more than two months of work on three occasions during my career. Fortunately in each case I had short term disability insurance that bridged my salary during the outage. Not all workers are so fortunate.

A handicapping accident may mean that a worker will be unable to return to the same type of job that he left.

On top of the fact that a major medical crisis may result in reduced or stopped income it also results in unexpected bills. The out-of-pocket expenses4 for a medical crisis may reach into thousands of dollars, and often the financial calamity associated with a medical crisis pushes people into bankruptcy.5

Debt at the tipping point

Unrestrained borrowing pushes individuals to a debt tipping point where paying off debt is unmanageable and where the interest alone on debt exceeds even their mortgage payment. I recently counseled a couple in this situation. Both husband and wife are fully employed: the husband in a trade job and the wife in the medical field. Their combined income is more than $100,000. They live in a simple home. But their deferred debt payments meant that their interest alone was more than $2,000 per month.

The interesting phenomenon with this crisis is that outwardly everything appears normal. Often a couple will have new cars, nice clothes, extras like a boat or a snowmobile. They are healthy, employed, and apparently wealthy. But the wealth is a chimera built on debt.

Divorce or other family crisis

Unmanageable debt is both a factor leading to divorce6 and a byproduct of divorce.7 A married couple barely making ends meet financially is less likely to prosper financially with two residences when divorced. Additionally an acrimonious divorce incurs massive legal fees.

Death of a spouse or family member

Death of the major breadwinner usually ends his or her income stream. Few prepare financially for death with adequate life insurance and provision for the costs associated with a funeral. The average cost of a funeral varies regionally but may be over $7,000.8

A relative of mine saved money on his mother-in-law’s funeral by shopping at Costco—but he didn’t buy the casket there. He just threatened to buy the casket there and the full-service funeral home matched Costco’s price.

Societal economic crisis with widespread impact

Little needs to be addressed here, since we in the United States have yet to recover from the 2008 financial crisis.9 Jobs lost have yet to be regained. Financial losses in the stock market have impacted the middle class and retirees alike. Often the “new job” pays much less than the job lost.

How do we help people in financial crisis?

In my experience, people in financial crisis usually truly need money but money alone will not resolve their need. Providing money alone in these cases, without other forms of help, may actually aggravate their financial crisis. Providing money—and this may come from individuals or through a church program like a “deacons’ fund”—is actually the easy part!

Steps the individual (or couple) should take:

- Pray (!) and have an accountability partner. What a great resource we have in knowing the Lord Jesus Christ! He promises “my God shall supply all your need according to His riches in glory by Christ Jesus” (Philippians 4:19). Tender hearted Christians are commanded “to meet urgent needs” (Titus 3:14). It’s great to be a member of a local church that cares for her members!

- Don’t delay! Financial crises rarely just resolve themselves. Take action today!

- Assess your situation. This is where an accountability partner will be a great help. This partner needs to be more than a commiserator; he needs to be a level-headed, wise counselor.

- Inform. Creditors appreciate being informed when a client is in financial distress. Often arrangements may be made for reduced or delayed payments. Such arrangements will help with managing one’s cash flow.

- Do a wants-needs analysis10 of what must be spent and what may be canceled or delayed. Areas ripe for savings:

- Eat at home. Completely eschew restaurants until the crisis passes. Pack a lunch for work!

- Cancel the cable and other unnecessary utilities. Cell phones should be evaluated—who in the family needs them, what types, level of service, etc.

- Cancel your vacation or do a “staycation.”

- Other resources for one in a financial crisis:

Steps to help another person in financial crisis

- For a church or church leader, it’s helpful to have a documented process in place. Issues that should be addressed include helping non-members, maximum amounts, maximum duration, and helping staff members.

- Be willing to personally help but beware of personally helping. If you directly help every counselee you will soon find yourself poor.

- Pray with the person.

- Direct the financial counselee to order a credit report. An earlier article in this series speaks to this. Review the credit report with the counselee. Less important is the FICO score but it could easily be combined with this step.

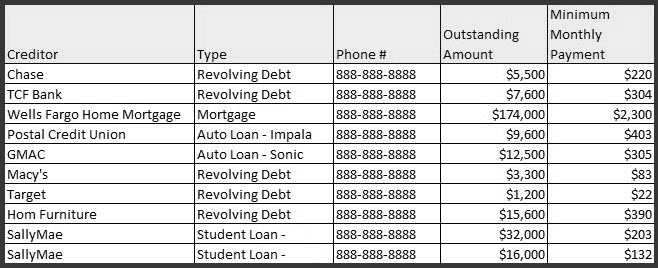

- Have the counselee list all debt. This should be very thorough an include the following:

- Do an expense and income analysis for last month. A previous article in this series addresses this.

- Create a budget worksheet for the upcoming month

- Create a recommendation for the Church leadership informing them of your recommendation to provide financial assistance. Document a plan to have the financial counselee back on solid ground.

Observations and opinions

- It’s possible for financial help to be hurtful if systemic issues11 are not addressed. Stated another way: to provide financial help without financial counseling is generally not helpful at all.

- Providing too much financial help makes one dependent upon the church.

- Providing a car to someone in financial crisis is not wise. The recipient is often unable to provide for maintenance, adequate insurance, and replacement parts like tires. In major metropolitan areas, public transportation is a better option.

Notes

6 http://www.prlog.org/12072796-household-debt-causes-marital-problems-as-more-marriages-end-in-divorce.html

9 http://www.usatoday.com/story/money/business/2013/09/14/impact-on-states-of-2008-financial-crisis/2812691/

Jim Peet Bio 2016

Jim is a retired pastor and a retired IT professional. He volunteers at Central Seminary.

- 4 views

8 signs you’re flirting with financial ruin

- Paying late fees and juggling bills

- Counting on a future windfall

- Multiple credit card hocus-pocus

- Fighting with your partner over finances

- Regularly paying overdraft fees

- You have a savings rate of zero

- Covering expenses with retirement savings

- Treating your home like a piggy bank

Model, advise, teach people to save something

63% Of Americans Don’t Have Enough Savings To Cover A $500 Emergency

The car brakes go on the fritz. The refrigerator stops refrigerating. The dog gets his paws on a batch of chocolate chip cookies and earns himself a trip to the vet ER.

These are just three of any number of things that could go wrong during the course of the year. Recovering from any one will set you back about $500, which means these scenarios fall closer to the “undesirable inconvenience” category than they do the “massive calamity” one. And yet, nearly two-thirds of Americans do not have enough money in savings to cover the cost of a single one of these unplanned expenses.

According to a brand new survey from Bankrate.com, just 37% of Americans have enough savings to pay for a $500 or $1,000 emergency. The other 63% would have to resort to measures like cutting back spending in other areas (23%), charging to a credit card (15%) or borrowing funds from friends and family (15%) in order to meet the cost of the unexpected event.

One of the most helpful things that Dave Ramsey says about these matters is that when a family is in deep in terms of debt, it’s “rice and beans” time. For the uninitiated, any grain (corn, rice, wheat, barley, etc..) plus any legume (any bean, split peas, etc..) gives not only a healthy dose of fiber, vitamins, and carbohydrates, but also a complete protein (all ten essential amino acids). That’s why so many ethnic foods are more or less a combination of beans and rice with vegetables and a little bit of meat or dairy.

(side note; you want to learn to eat what the natives eat if you’re becoming a missionary? there you go—all you need to do is figure out what meats, herbs and spices, and vegetables they prefer)

It’s also incredibly cheap, of course.

Along these lines, one thing I’ve noticed when helping fairly poor people move (my pickup truck gets invited and I come, too) is that I always see a huge array of packaged foods and a huge array of inexpensive clothes from places like Wal-Mart. There is also usually far more furniture than I have in my home. Same thing when I helped a church prepare a garage sale in Compton—South Central LA, very poor area. The array of womens’ shoes was just spectacular.

Now it isn’t easy to persuade someone that they’re self-sabotaging their financial efforts, but I’ve got a hunch that if a person has poorer friends over for lunch (maybe even inviting them into the kitchen and showing them the house), one can start modeling a better way for them. Two of the best compliments I’ve ever received came from a relative who grew up poor. She and her husband came to help us when our first was born, and when they wanted to cook for us, she asked “where is your food?” We had plenty, it just wasn’t packaged. Then more recently, she commented “you guys never buy anything.” Well, not quite, but we do buy quality and wear it out. Thanks, sis!

Aspiring to be a stick in the mud.

Here’s a Financial Question That Should Worry Everybody

How confident are you that you could come up with $2,000 if an unexpected need arose within the next month? …

Today, 1 in 3 people could not come up with the $2,000 within a month.

…

The $2,000 question takes the pulse of the economy by analyzing household resilience.

Times I’ve had to respond to an unexpected financial need:

- Twice transmission replacements

- Sudden death of my mother-in-law necessitating a trip from Denver to Tampa

- Surgery twice in 7 month period

Discussion